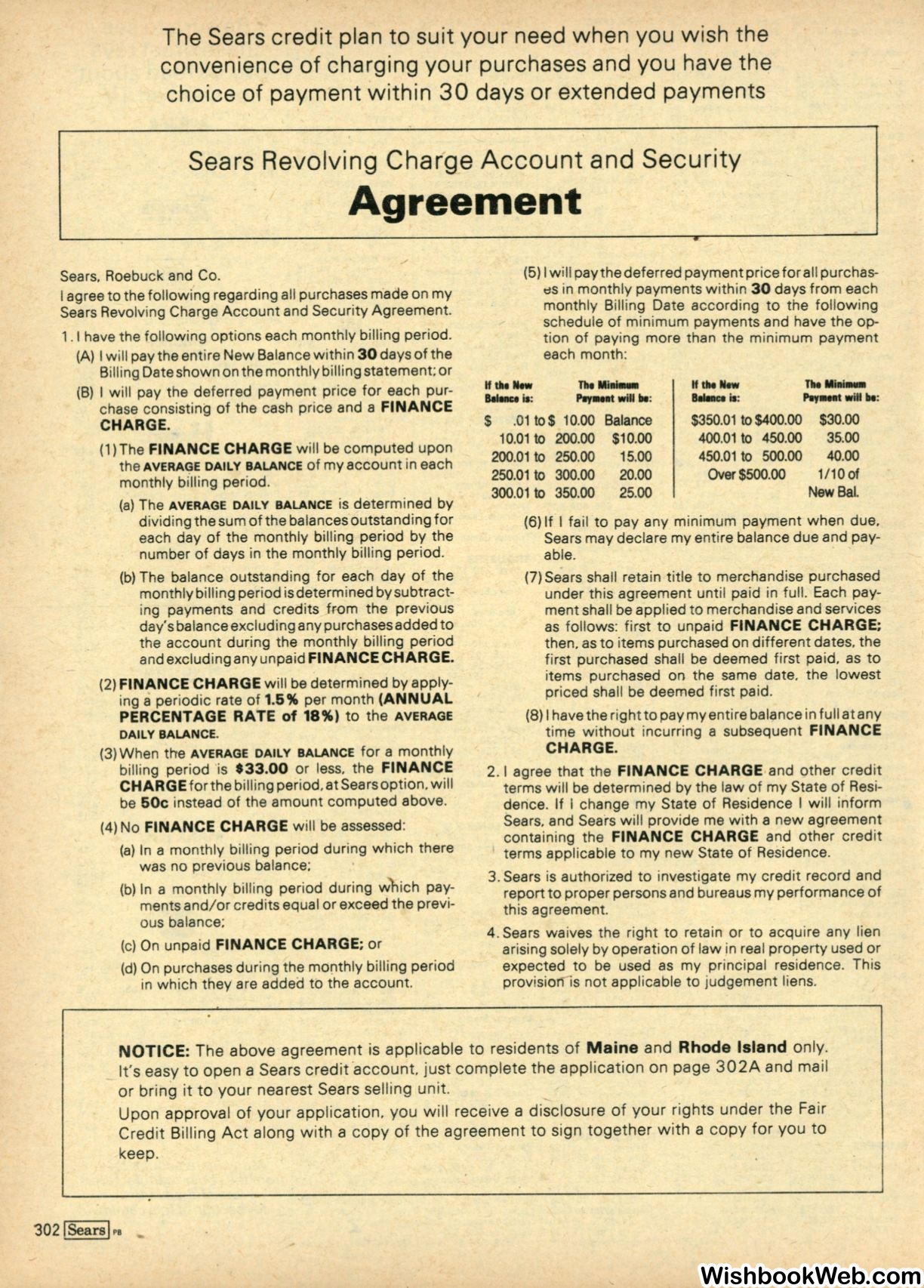

The Sears credit plan to suit your need when you wish the

convenience of charging your purchases and you have the

choice of payment within 30 days or extended payments

Sears Revolving Charge Account and Security

Agreement

Sears. Roebuck and Co.

I agree to the

followi.ngregarding all purchases made on my

Sears Revolving Charge Account and Security Agreement.

1.1

have the following options each monthly billing period.

(A) I will pay the entire New Balance within 30 days of the

Billing Date shown on the monthly billing statement; or

(B) I will pay the deferred payment price for each pur–

chase consisting of the cash price and a FINANCE

CHARGE.

(1) The FINANCE CHARGE will be computed upon

the

AVERAGE DAILY BALANCE

of my account in each

monthly billing period.

(a) The

AVERAGE DAILY BALANCE

is determined by

dividing the sum of the balances outstanding for

each day of the monthly billing period by the

number of days in the monthly billing period.

(b) The balance outstanding for each day of the

monthly billing period is determined by subtract–

ing payments and credits from the previous

day's balance excluding any purchases added to

the account during the monthly billing period

and excluding any unpaid FINANCE CHARGE.

(2) FINANCE CHARGE will be determined by apply–

ing

a

periodic rate of

1.5%

per month (ANNUAL

PERCENTAGE RATE of

18%)

to the

AVERAGE

DAILY BALANCE.

(3)When the

AVERAGE DAILY BALANCE

for a monthly

billing period is $33.00 or less, the FINANCE

CHARGE forthe billing period, at Sears option. will

be 50c instead of the amount computed above.

(4) No FINANCE CHARGE will be assessed:

(a) In a monthly billing period during which there

was no previous balance;

(b) In a monthly billing period during which pay–

ments and/or credits equal or exceed the previ–

ous balance;

(c) On unpaid FINANCE CHARGE; or

(d) On purchases during the morithly billing period

in which they are added tb the account.

$

(5) Iwill pay the deferred payment price for all purchas–

~s

in monthly payments within 30 days from each

monthly Billing Date according to the following

schedule of minimum payments and have the op–

tion of paying more than the minimum payment

each month:

.01 to$

1 o.ooBalance

10.01

to

200.00

$10.00

200.01

to

250.00

15.00

250.01 to 300.00

20.00

300.01

to

350.00

25.00

$350.01 to $400.00

400.01 to 450.00

450.01 to 500.00

Over

$500.00

TlieMilli–

l'1!y.-t

wiH

lie:

$30.00

35.00

40.00

1/10 of

New

Bal.

(6) If I fail to pay any minimum payment when due,

Sears may declare my entire balance due and pay–

able.

(7) Sears shall retain title to merchandise purchased

under this agreement until paid in full. Each pay–

ment shall be applied to merchandise and services

as follows: first to unpaid FINANCE CHARGE;

then, as to items purchased on different dates, the

first purchased shall be deemed first paid, as to

items purchased on the same date, the lowest

priced shall be deemed first paid.

(8) I have the right to pay my entire balance in full at any

time without incurring a subsequent FINANCE

CHARGE.

2. I agree that the FINANCE CHARGE and other credit

terms will be determined by the law of my State of Resi–

derice. If

i

change my State of Residence I will inform

Sears, and Sears will provide me with a new agreement

containing the FINANCE CHARGE and other credit

terms applicable to my new State of Residence.

3. Sears is authorized to investigate my credit record and

report to proper persons and bureaus my performance of

this agreement.

4. Sears waives the right to retain or to acquire any lien

arising solely by operation of law in real property used or

expected to be used as my principal residence. This

provisiorlis not applicable to judgement liens.

NOTICE:

The above agreement is applicable to res idents of

Maine

and

Rhode Island

only.

It's easy to open a Sears credit'account. just complete the application on page 302A and mail

or bring it to your nearest Sears selling unit.

Upon approval of your application, you will receive a disclosure of your rights under the Fair

Credit Billing Act along with a copy of the agreement to sign together with a copy for you to

keep.

'302

I

Sears

I

Pe