SEARS, ROEBUCK AND CO.

SEARSCHARGE SECURITY AGREEMENT

RETAIL INSTALLMENT SECURITY AGREEMENT

On all charges to my SearsCharge account, I agree to the following:

1.

Option to Pay i n Full Each Month to Avo i d Fi nance

Charges. I have the right each month to pay the total balance

on my account. If I do so within

3 0

days of my billing date, no

Finance Charge will be added to the account for that month.

The billing date will be shown on a statement sent to me each

month. The total balance on my billing date will be called the

New Balance on my monthly statement.

2.

Option to Pay Installments Plus a Finance Charge. If I do

not pay t he total balance in full each month, I agree to make at

least a minimum payment within

30

days of the billing date

shown on my monthly statement. The minimum payment re–

q u1 red each month is shown in t he Schedu le of Minimum

Monthly Payments below.

3.

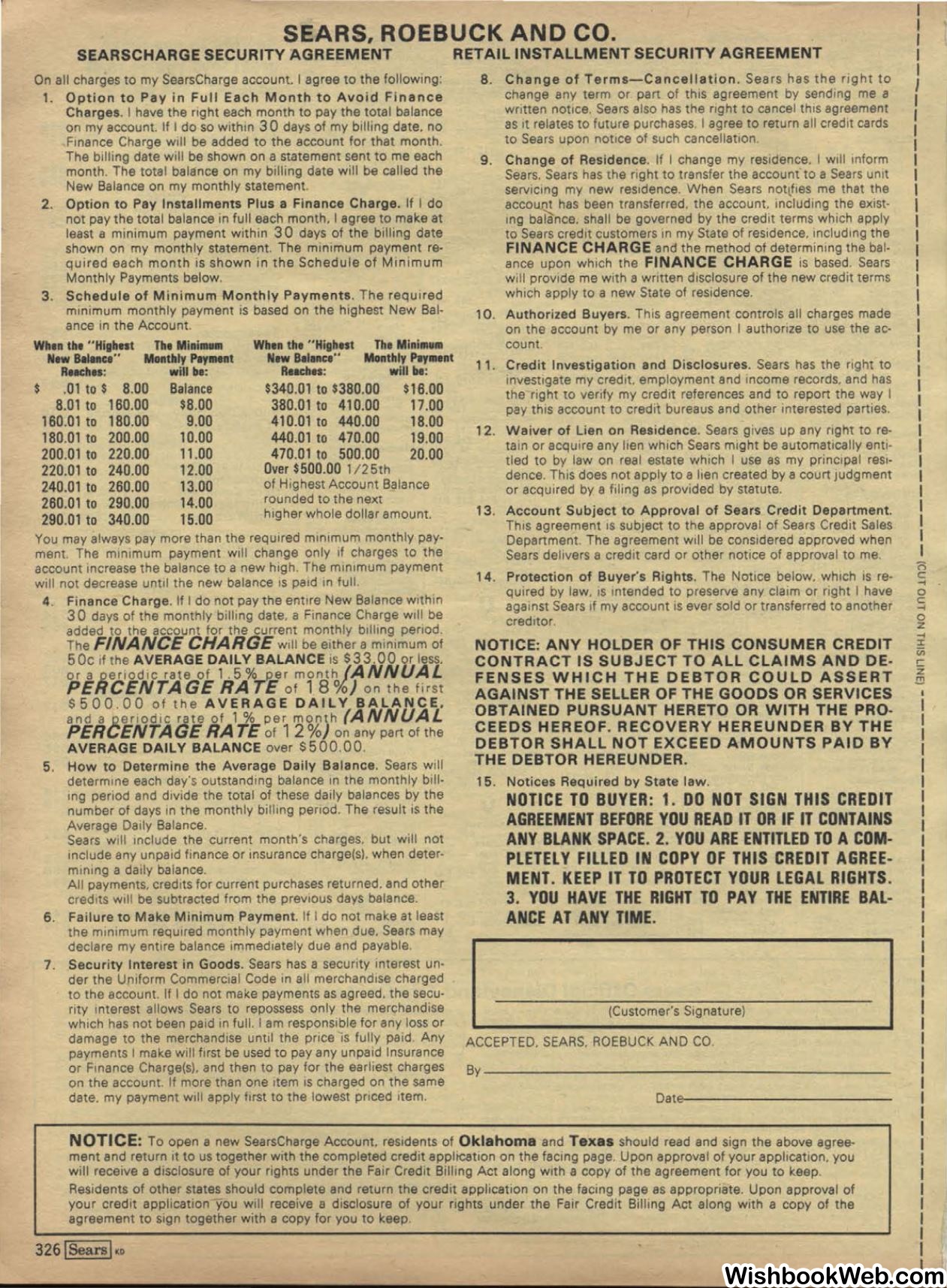

Schedule of M inimum Monthly Payments. The required

minimum monthly payment 1s based on the highest New Bal–

ance in the Account

When th• "Highest The Minimum

New Balance"

Monthly Pay1111nt

Reaches:

will

be:

$

.01

to

$

8.00

Balance

8.01

to

160.00

$8.00

160.01

to

180.00

9.00

180.01

to

200.00

10.00

200.01

to

220.00

11.00

220.01

to

240.00

12.00

240.01

to

260.00

13.00

260.01

to

290.00

14.00

290.01

to

340.00

15.00

When the " Highest

New Betance"

Reaches:

The Minimum

Monthly Payment

will

be:

$340.01

to

$380.00

380.01

to

410.00

410.01

to

440.00

440.01

to

470.00

470.01

to

500.00

Over

$500.00 1/25th

$16.00

17.00

18.00

19.00

20.00

of Highest Account Balance

rounded to the next

higher whole dollar amount.

You may always pay more than the required minimum monthly pay–

ment The minimum payment will change only 1f charges to the

account increase the balance to a new high. The minimum payment

will not decrease until the new balance 1s paid in full.

4

Finance Charge. If I do not pay the entire New Balance within

30

days of the monthly billing date, a Finance Charge will be

added to the account for the current monthly billing period.

The

FINANCE CHARGE

will be either a minimum of

50c

1f the AVERAGE DAILY BALANCE is

$33.00

or less.

or a ..12,er1odic rate of

1. 5 %

Qer month

(ANNUAL

PEHCENTA GE RA TE

of

1 8

%)

on the first

$500.00

of the AVERAGE DAILY BALANCE,

and a .12.eriod1c rate of

1

%

per month

(ANNUAL

PERc;ENTAGE RATE

of

12

%)

on any part of the

AVERAGE DAILY BALANCE over

$500.00.

5 .

How to Determine the Average Daily Balance. Sears will

determine each day's outstanding balance in the monthly b1ll-

1ng period and d1v1de the total of these daily balances by the

number of days in the monthly billing period. The result is the

Average Daily Balance.

Sears will include the current month's charges, but will not

include any unpaid finance or insurance charge(s). when deter–

mining a daily balance.

All payments, credits for current purchases returned. and other

credits will be subtracted from the previous days balance.

6.

Failure t o Make Minimum Payment. If I do not make at least

the minimum required monthly payment when due. Sears may

declare my entire balance immediately due and payable.

7.

Security Interest in Goods. Sears has a security interest un–

der the Uniform Commercial Code 1n all merchandise charged

to the account. If I do not make payments as agreed. the secu–

rity interest allows Sears to repossess only the merchandise

which has not been paid 1n full. I am responsible for any loss or

damage to the merchandise until the price is fully paid. Any

payments I make will first be used to pay any unpaid Insurance

or Finance Charge(s). and then to pay for the earliest charges

on the account. If more than one item 1s charged on the same

date. my payment will apply first to the lowest priced item.

8. Change of Te rms-Cance ll ati on . Sears has the right to

change any term or part of this agreement by sending me a

written notice. Sears also has the rrght to cancel this agreement

as 1t relates to future purchases. I agree to return all credit cards

to Sears upon notice of such cancellation.

9 .

Change of Residence. If I change my residence. I will inform

Sears. Sears has the right to transfer the account to a Sears unit

servicing my new residence. When Sears notLf1es me that the

accouQ! has been transferred, the account. including the exist–

ing balance. shall be governed by the credit terms which apply

to Sears credit customers in my State of residence, including the

FINANCE CHARGE

and the method of determining the bal–

ance upon which the

FINANCE CHARGE

is based. Sears

will provide me with a written disclosure of the new credit terms

which apply to a new State of residence.

1O.

Authorized Buyers. This agreement controls all charges made

on the account by me or any person I authorize to use the ac–

count.

11 .

Credit Investigation and Disclosures. Sears has the right to

investigate my credit, employment and income records, and has

the right to verrfy my credit references and to report the way I

pay this account to credit bureaus and other interested parties.

12.

Waiver of Li en on Residence. Sears gives up any right to re–

tain or acquire any lien which Sears might be automatically enti–

tled to by law on real estate which I use as my principal resi–

dence. This does not apply to a lien created by a court Judgment

or acquired by a filing as provided by statute.

13.

Account Subject to Approval of Sears Credit Department.

This agreement 1s subiect to the approval of Sears Credit Sales

Department. The agreement will be considered approved when

Sears delivers a credit card or other notice of approval to me.

14.

Protection of Buyer's Rights. The Notice below. which 1s re–

quired by law. 1s intended to preserve any claim or right I have

against Sears 1f my account 1s ever sold or transferred to another

creditor.

NOTICE: ANY HOLDER OF THIS CONSUMER CREDIT

CONTRACT IS SUBJECT TO ALL CLAIMS AND DE–

FENSES WHICH THE DEBTOR COULD ASSERT

AGAINST THE SELLER OF THE GOODS OR SERVICES

OBTAINED PURSUANT HERETO OR WITH THE PRO–

CEEDS HEREOF. RECOVERY HEREUNDER BY THE

DEBTOR SHALL NOT EXCEED AMOUNTS PAID BY

THE DEBTOR HEREUNDER.

15.

Notices Required by State law.

NOTICE TO BUYER: 1. DO NOT SIGN THIS CREDIT

AGREEMENT BEFORE YOU READ IT OR IF IT CONTAINS

ANY BLANK SPACE. 2. YOU ARE ENTITLED TO ACOM–

PLETELY FILLED IN COPY OF THIS CREDIT AGREE–

MENT. KEEP IT TO PROTECT YOUR LEGAL RIGHTS.

3. YOU HAVE THE RIGHT TO PAY THE ENTIRE BAL–

ANCE AT ANY TIME.

(Cust omer's Signature)

ACCEPTED, SEARS. ROEBUCK AND CO.

By~~~~~~~~~~~~~~~~~~~~~~~-

NOTICE:

To open a new SearsCharge Account. residents of

Oklahoma

and

Texas

should read and sign the above agree–

ment and return 1t to us together with the completed credit applrcation on the facing page. Upon approval of your application, you

w ill receive a disclosure of your rights under the Fair Credit Billing Act along with a copy of the agreement for you to keep.

Residents of ot her states should complete and return the credit application on the facing page as appropriat e. Upon approval of

your credit application Vou will receive a disclosure of your rights under the Fair Credit Billing Act along with a copy of the

agreement to sign together with a copy for you to keep.

326

lSearsl

Ko

I

I

I

I

I

I

I

I

I

I

I

I

n

c

....

0

c

....

0

z

....

::c

c;;

,..

z

!!!