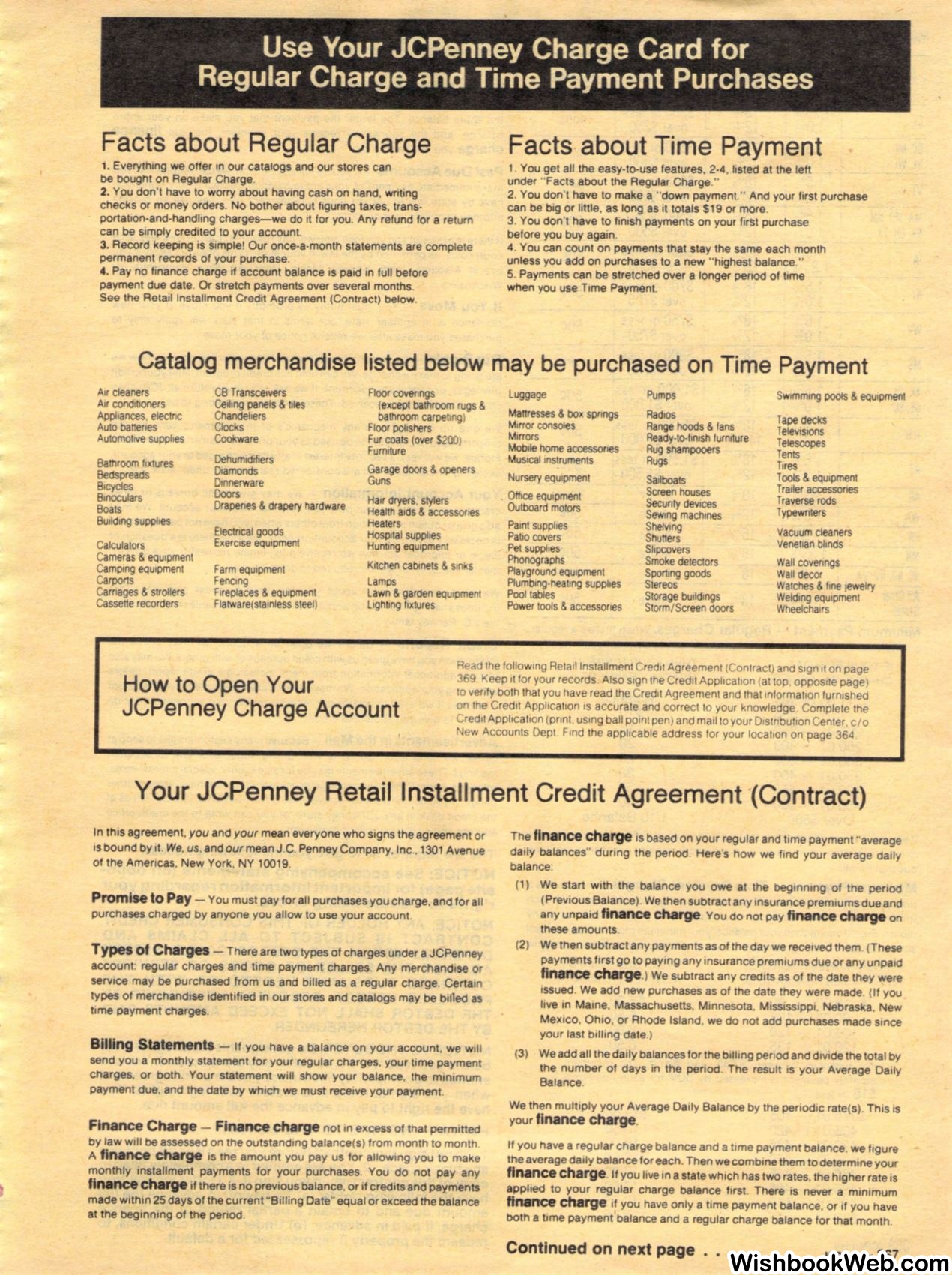

Use Your JCPenney Charge Card for

Regular Charge and Time Payment Purchases

Facts about Regular Charge

1. Everything we offer in our catalogs and our stores can

be bought on Regular Charge.

2. You don't have to worry about having cash on hand, writing

checks or money orders. No bother about figuring taxes, trans·

portation-and-handling charges-we do 11 for you. Any relund for a return

can be simply credited to your account.

3. Record keeping is simple! Our once-a-month statements are complete

permanent records of your purchase.

4.

Pay no finance charge 1f account balance is paid in full before

payment due date. Or stretch payments over several months.

See the Retail Installment Credit Agreement (Contract) below.

Facts about Time Payment

1. You get all the easy-to-use features, 2-4, listed at the left

under " Facts about the Regular Charge."

2. You don"t have to make a "down payment." And your first purchase

can be big or little, as long as it totals $19 or more.

3. You don't have to finish payments on your first purchase

before you buy again.

4. You can count on payments that stay the same each month

unless you add on purchases to a new " highest balance."

5. Payments can be stretched over a longer period of time

when you use Time Payment.

Catalog merchandise listed below may be purchased on Time Payment

Air cleaners

CB Transce1vers

Floor coverings

Luggage

Pumps

Swimming pools

&

equipment

Air cond1t10ners

Ceiling panels

&

tiles

(except bathroom rugs

&

Mattresses

&

box spnngs

Radios

Appliances. electric

Chandeliers

bathroom carpe ng)

Tape decks

Auto batteries

Clocks

Floor polishers

Mirror consoles

Range hoods

&

fans

Televisions

Automotive supplies

Cookware

Fur coats (over $200)

Mirrors

Ready-to-linish furniture

Telescopes

Furniture

Moblle

home

accessories

Rug shampooers

Tents

Bathroom fixtures

Dehumidifiers

Musical instruments

Rugs

Tires

Bedspreads

Diamonds

Garage doors

&

openers

Nursery equipment

Sailboats

Tools

&

equipment

Bicycles

Dinnerware

Guns

Screen houses

Trailer accessones

Blriocutars

Doors

Hair dryers. stylers

. Office equipment

Security devices

Traverse rods

Boats

Drapenes

&

drapery hardware

Health aids

&

accessories

Outboard motors

Sewing machines

Typewriters

Building supplies

Heaters

Paint supplies

Shelving

Vacuum cleaners

Electrical goods

Hospital supplies

Patio covers

Shutters

Venetian blinds

Calculators

Exercise equipment

Hunting equipment

Pet supplies

Slipcovers

Cameras

&

equipment

Kitchen cabinets

&

sinks

Phonographs

Smoke detectors

Wall coverings

Camping equipment

Farm equipment

Playground equipment

Sporting goods

Wall decor

Carports

Fencing

Lamps

Plumbtng-heallng supplies

Stereos

Watches

&

fine lewelry

Carnages

&

strollers

Fireplaces

&

equipment

Lawn

&

garden equipment

Pool tables

Slorage buildings

Welding equipment

Cassette recorders

Fla1Ware(sta1nless steel)

Lighting fixtures

Power tools

&

accessories

Slorm/Screen doors

Wheelchairs

How to Open Your

JCPenney Charge Account

Read the following Retail Installment Cred1I Agreement (Conlract) and sign 1t on page

369 Keep 1t for your records Also sign the Credit Application (at top, opposite page)

to verify both that you have read the Credit Agreement and lhal 1nformat1on furnished

on the Cred1I Apphca11on 1s accurale and correct lo your knowledge. Complete the

Cred1I Apphca11on (prinl. using ball point pen) and mail to your D1stnbuhon Center, c/o

New Accounts Dept. Find the applicable address for your location on page 364

Your JCPenney Retail Installment Credit Agreement (Contract)

In this agreement,

you

and

your

mean everyone who signs the agreement or

is bound by it.

We.

us,and

our

mean J.C. Penney Company, Inc.. 1301 Avenue

of the Americas. New York, NY 10019.

Promise to Pay

-

You must pay for all purchases you charge, and for all

purchases charged by anyone you allow to use your account.

Types of

Charges

-

There are two types of charges under a JCPenney

account: regular charges and time payment charges. Any merchandise or

service may

be

purchased from us and billed as a regular charge. Certain

types of merchandise identified in our stores and catalogs may be billed as

time payment charges.

Billing Statementa

-

If you have a balance on your account. we will

send you a monthly statement for your regular charges. your time payment

charges. or both. Your statement will show your balance. the minimum

payment due, and the date by which we must receive your payment.

Finance Charge - Finance charge

not in excess of that permitted

by law will be assessed on the outstanding balance(s) from month to month.

A

finance charge

1s the amount you pay us for allowing you to make

monthly installment payments for your purchases. You do not pay any

finance charge

if there is no previous

balance.orif credits and payments

made within 25 days of the current "Billing Date" equal or exceed the balance

at the beginning of the period.

The

finance charge

is based on your regular and time payment "average

daily balances" during the period. Here's how we find your average daily

balance:

(1)

We start with the balance you owe at the beginning of the period

(Previous Balance).We then subtract any insurance premiums due and

any unpaid

finance charge.

You do not pay

finance charge

on

these amounts.

(2) We then subtract any payments as of the day we received them. (These

payments first go to paying any insurance premiums due or any unpaid

finance charge.)

We subtract any credits as of the date they were

issued. We add new purchases as of the date they were made.

(If

you

live in Maine. Massachusetts. Minnesota. Mississippi, Nebraska. New

Mexico, Ohio, or Rhode Island. we do not add purchases made since

your last billing date.)

(3) We add all the daily balances for the billing period and divide the total by

the number of days in the period. The result is your Average Daily

Balance.

We then multiply your Average Daily Balance by the periodic rate(s). This is

your

finance charge.

If you have a regular charge balance and a time payment balance. we figure

the average daily balance for each.Then we combine them to determine your

finance charge.

If you live in a state which has two rates. the higher rate is

applied to your regular charge balance first. There is never a minimum

finance charge

if you have only a time payment balance. or if you have

both a time payment'balance and a regular charge balance for that month.

Continued on next page

. . .

JCPenney

367