MontgomeryWard Charg-all Retail Installment Credit Agreement

The terms of this agreement apply in Minnesota.

If

you live in another state, a copy

of the proper agreement for your state

will

be sent to you.

Iagree to the following terms regarding all purchases made

by me or by anyone else with my permission on my Mont–

gomery Ward "Charg-all" credit card account:

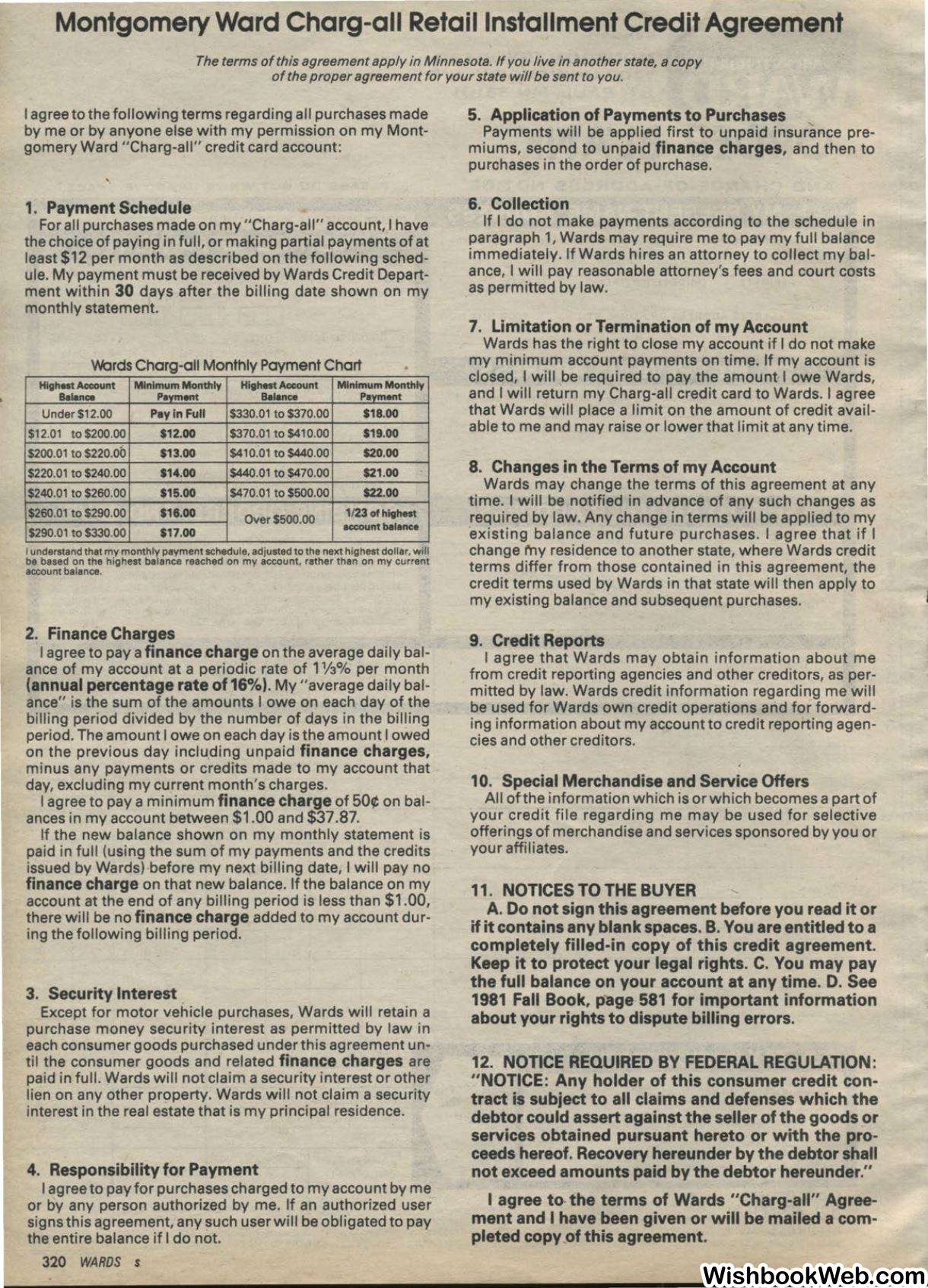

1. Payment Schedule

For all purchases made on my "Charg-all" account, I have

the choice of paying in full, or making partial payments of at

least

$12

per month as described on the following sched–

ule. My payment must be received by Wards Credit Depart–

ment within 30 days after the billing date shown on my

monthly statement.

\M:Jrds Charg-all Monthly Payment Chart

Highat Account

Minimum Monthly

Highest Account

Minimum Monthly

Balan..

Pavment

Balan..

Pavment

Under $12.00

Peyinfull

$330.01 to $370.00

$18.00

$12.01 to$200.00

$12.00

$370.01 to $410.00

$19.00

$200.01 to $220.00

$13.00

$410.01 to $440.00

$20.00

$220.01 to $240.00

$14.00

$440.01 to $470.00

$21.00

$240.01 to $260.00

$15.00

$470.01 to $500.00

$22.00

$260.01 to $290.00

$16.00

Over $500.00

1123

of

highest

$290.01 to $330.00

$17.00

account balance

Iunderstand that my monthly payment schedule, adjusted to the next highest dollar, will

be based on the highest balance reached on my account. rather than on my current

account balance.

2. Finance Charges

I agree to pay a

finance charge

on the average daily bal–

ance of my account at a periodic rate of

1

%%

per month

(annual percentage rate of 16%).

My "average daily bal–

ance" is the sum of the amounts I owe on each day of the

billing period divided by the number of days in the billing

period. The amount I owe on each day is the amount I owed

on the previous day inclu,ding unpaid

finance charges,

minus any payments or credits made to my account that

day, excluding my current month's charges.

I agree to pay a minimum

finance charge

of 50¢ on bal–

ances in my account between

$1.00

and

$37

.87.

If the new balance shown on my monthly statement is

paid in full (using the sum of my payments and the credits

issued by Wards) before my next billing date, I will pay no

finance charge

on that new balance. If the balance on my

account at the end of any billing period is less than

$1.00,

there will be no

finance charge

added to my account dur–

ing the following billing period.

3. Security Interest

Except for motor vehicle purchases, Wards will retain a

purchase money security interest as permitted by law in

each consumer goods purchased under this agreement un–

til the consumer goods and related

finance charges

are

paid in full. Wards will not claim a security interest or other

lien on any other property. Wards will not claim a security

interest in the real estate that is my principal residence.

4. Responsibility for Payment

I agree to pay for purchases charged to my account by me

or by any person authorized by me. If an authorized user

signs this agreement, any such user will be obligated to pay

the entire balance if I do not.

320

WARDS

s

5. Application of Payments to Purchases

Payments will be applied first to unpaid insurance pre–

miums, second to unpaid

finance charges,

and then to

purchases in the order of purchase.

6. Collection

If I do not make payments according to the schedule in

paragraph 1, Wards may require me to pay my full balance

immediately. If Wards hires an attorney to collect my bal–

ance, I will pay reasonable attorney's fees and court costs

as permitted by law.

7. Limitation or Termination of my Account

Wards has the right to close my account if I do not make

my minimum account payments on time. If my account is

closed, I will be required to pay the amount I owe Wards,

and I will return my Charg-all credit card to Wards. I agree

that Wards will place a limit on the amount of credit avail–

able to me and may raise or lower that limit at any time.

8. Changes in the Terms of my Account

Wards may change the terms of this agreement at any

time. I will be notified in advance of any such changes as

required by law. Any change in terms will be applied to my

existing balance and future purchases. I agree that if I

change my residence to another state, where Wards credit

terms differ from those contained in this agreement, the

credit terms used by Wards in that state will then apply to

my existing balance and subsequent purchases.

9. Credit Reports

I agree that Wards may obtain information about me

from credit reporting agencies and other creditors, as per–

mitted by law. Wards credit information regarding me will

be used for Wards own credit operations and for forward–

ing information about my account to credit reporting agen–

cies and other creditors.

10. Special Merchandise and Service Offers

All otthe information which is or which becomes a part of

your credit file regarding me may be used for selective

offerings of merchandise and services sponsored by you or

your affiliates.

11. NOTICES TO THE BUYER

A. Do not sign this agreement before you read it or

if it contains any blank spaces. B. You are entitled to a

completely filled-in copy of this credit agreement.

Keep it to protect your legal rights. C. You may pay

the full balance on your account at any time. D. See

1981 Fall Book, p-age 581 for important information

about your rights to dispute billing errors.

12. NOTICE REQUIRED BY FEDERAL REGULATION:

"NOTICE: Any holder of this consumer credit con–

tract is subject to all claims and defenses which the

debtor could assert against the seller of the goods or

services obtained pursuant hereto or with the pro–

ceeds hereof. Recovery hereunder by the debtor shall

not exceed amounts paid by the debtor hereunder."

I agree to the terms of Wards "Charg-all" Agree–

ment and I have been given or will be mailed a com–

pleted copy of this agreement.