S31't1S 031/Nn

3H1NI

037/'tW :II

M'v'SSD3N

3fJ'v'lSOdON

I'I'I''I'I' 'I'I

111 l'

I

11

I'I'I'I

1Il

1111

l1I1 111 II1 1II1 I

111111

SS66·S l S09

1l

18A0.19

S.18UMOQ

\'9S L

xoa

·o·d

ll3lN3:> NOllY:>llddY M3N

·o:> GNY >1:>n&30ll

1

Sl1Y3S

33SS31!aav AB al'v'd 38

lllM

38'v'lSOd

11 'OD\OIH:J

l LL "ON

1/WlEJd

SS'v'D 1S8/:i

71VW A7dlll SSINISRB

- - -- --- -- - -- - -- - - -- - - - - - - - - - - - - - - - - - - - -- -

umaN>t 7>t3S 'a10:11snr

- - -- - - -- - - - - - - - - - - - --- -- ---- - - --- --- -

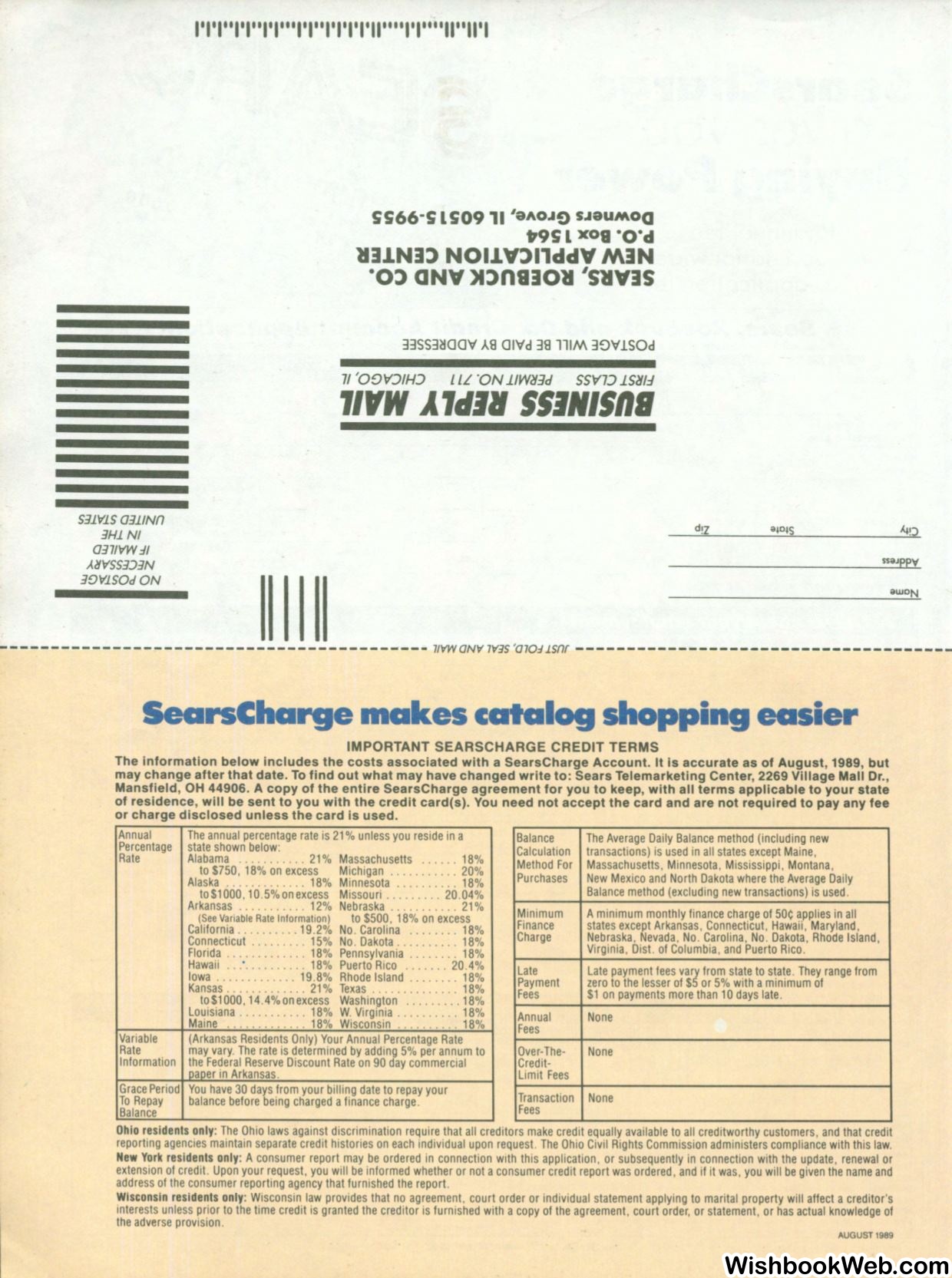

SearsCharge makes catalog shopping easier

IMPORTANT SEARSCHARGE CREDIT TERMS

The information below includes the costs associated with a SearsCharge Account. It Is accurate as of August, 1989, but

may change after that date. To find out what may have changed write to: Sears Telemarketing Center, 2269 Village Mall Dr.,

Mansfield, OH 44906. A copy of the entire SearsCharge agreement for you to keep, with all terms applicable to your state

of residence, will be sent to you with the credit card(s). You need not accept the card and are not required to pay any fee

or charge disclosed unless the card is used.

Annual

Percentage

Rate

Variable

Rate

Information

Grace Period

To Repay

Balance

The annual percentage rate is 21 %unless you reside in a

state shown below:

Alabama

....... . 21 % Massachusetts ...... 18%

to $750. 18% on excess

Michigan

....... 20%

Alaska ............. 18% Minnesota

...... 18%

to$1000, 10.5%onexcess Missouri ... . . .. .. 20.04%

Arkansas ........... 12% Nebraska . . . .. .. .... 21 %

(SeeVariable Rate Information)

to $500, 18% on excess

California .......... 19.2% No . Carolina

.. 18%

Connecticut . . . .

. 15% No. Dakota .... . ..... 18%

Florida ............. 18% Pennsylvania ........ 18%

Hawaii ...... . ..... . 18% Puerto Rico

.... 20.4%

Iowa . . . . . . .

. ... 19.8% Rhode Island ........ 18%

Kansas ............. 21 % Texas . . . .......... 18%

to$1000, 14.4%onexcess Washington ......... 18%

Louisiana ........... 18%

W.

Virginia .

. . 18%

Maine

. . . . . . . . .

. . 18% Wisconsin .......... 18%

(Arkansas Residents Only) Your Annual Percentage Rate

may vary. The rate is determined by adding 5% per annum to

the Federal Reserve Discount Rate on 90 day commercial

oaoer in Arkansas .

You have 30 days from your billing date to repay your

balance before being charged afinance charge.

Balance

Calculation

Method For

Purchases

Minimum

Finance

Charge

Late

Payment

Fees

Annual

Fees

Over-The-

Credit-

Limit Fees

Transaction

Fees

The Average Daily Balance method (including new

transactions) is used in all states except Maine,

Massachusetts, Minnesota, Mississippi, Montana,

New Mexico and North Dakota where the Average Daily

Balance method (excluding new transactions) is used.

Aminimum monthly finance charge of

50~

applies in all

states except Arkansas , Connecticut, Hawaii, Maryland,

Nebraska, Nevada, No. Carolina, No . Dakota, Rhode Island,

Virginia, Dist. of Columbia, and Puerto Rico.

Late payment fees vary from state to state. They range from

zero to the lesser of $5 or 5%with aminimum of

$1 on payments more than 10 days late.

None

None

None

Ohio residents only: The Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers, and that credit

reporting agencies maintain separate credit histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law.

New York residents only: A consumer report may be ordered in connection with this application , or subsequently in connection with the update, renewal or

extension of credit. Upon your request , you will be informed whether or not aconsumer credit report was ordered , and if it was , you will be given the name and

address of the consumer reporting agency that furnished the report.

Wisconsin residents only: Wisconsin law provides that no agreement, court order or individual statement applying to marital property will affect a creditor's

interests unless prior to the time credit is granted the creditor is furnished with acopy of the agreement, court order, or statement, or has actual knowledge of

the adverse provision.

AUGUST1989