Failure to Pay-If

you do not pay as you have agreed, we may require that you

immediately pay the entire balance of your account.

You agree to pay reasonable attorney's fees and the court costs if we have an

attorney bring a lawsuit against you to collect your account debt and you lose the

case.

Our Rights-Warning:

We can change our credit terms at any time. We will

notify you in advance of any such changes as required by law. Our new terms

may be applied to the existing balance on your account. We can limit or cancel

your credit privileges. All JCPenney credit cards belong to us. and you must

return them at our request.

We give up any lien the law gives us automatically for work performed by us or

materials installed by us on real property used or expected to be used as your

principal residence. If you live in Florida, we will keep asecurity interest in any

items charged to your account, except for those items that are considered real

property under state law.

Transfer of Accounts-We

may sell, assign or otherwise transfer your account

and/or account balance. as well as this Agreement and all rights and duties

under it.

Credit Bureau Reports-To

check the information on your application, we may

get a report about you from acredit bureau. When you have an account, we may

get acredit report to update our records or to decide whether to give you

additional credit. Ask us and we will tell you if we requested acredit report and

give you the name and address of the credit bureau.

YOUR BILLING RIGHTS-KEEP THIS NOTICE

FOR FUTURE USE

This notice contains important information about your rights and our

responsibilities under the Fair Credit Billing Act.

Notify Us in Case of Errors or Questions About Your Bill

If you think your bill is wrong, or if you need more information about atransaction

on your bill, write us (on a separate sheet) at the address listed on your bill. Write

to us as soon as possible. We must hear from you no later than 60 days after we

sent you the first bill on which the error or problem appeared. You can telephone

us. but doing so will not preserve your rights.

In your letter. give us the following information:

•

Your name and account number.

•

The dollar amount of the suspected error.

• Describe the error and explain, if you can, why you believe there is an error. If

you need more information, describe the item you are not sure about.

Your Rights and Our Responsibilities After We Receive Your Written

Notice

We must acknowledge your letter within 30 days, unless we have corrected the

error by then. Within 90 days, we must either correct the error or explain why we

believe the bill was correct.

After we receive your letter, we cannot try to collect any amount you question, or

report you as delinquent. We can continue to bill you for the amount you

question, including finance charges, and we can apply any unpaid amount against

your credit limit. You do not have to pay any questioned amount while we are

investigating, but you are still obligated to pay the parts of your bill that are not in

question.

If we find that we made a mistake on your bill, you will not have to pay any

finance charges related to any questioned amount. If we didn't make a mistake,

you may have to pay finance charges, and you will have to make up any missed

payments on the questioned amount. In either case, we will send you a statement

of the amount you owe and the date that 1t is due.

If you fail to pay the amount that we think you owe, we may report you as

delinquent. However, if our explanation does not satisfy you and you write to us

within ten days telling us that you still refuse to pay, we must tell anyone we

report you to that you have a question about your bill. And, we must tell you the

name of anyone we reported you to. We must tell anyone we report you to that

the matter has been settled between us when it finally is.

If we don't follow these rules, we can't collect the first $50 of the questioned

amount, even if your bill was correct.

NOTICE: ANY HOLDER OF THIS CONSUMER CREDIT CONTRACT

IS SUBJECT TO ALL CLAIMS AND DEFENSES WHICH THE

DEBTOR COULD ASSERT AGAINST THE SELLER OF GOODS OR

SERVICES OBTAINED PURSUANT HERETO OR WITH THE

PROCEEDS HEREOF. RECOVERY HEREUNDER BY THE DEBTOR

SHALL NOT EXCEED AMOUNTS PAID BY THE DEBTOR

HEREUNDER.

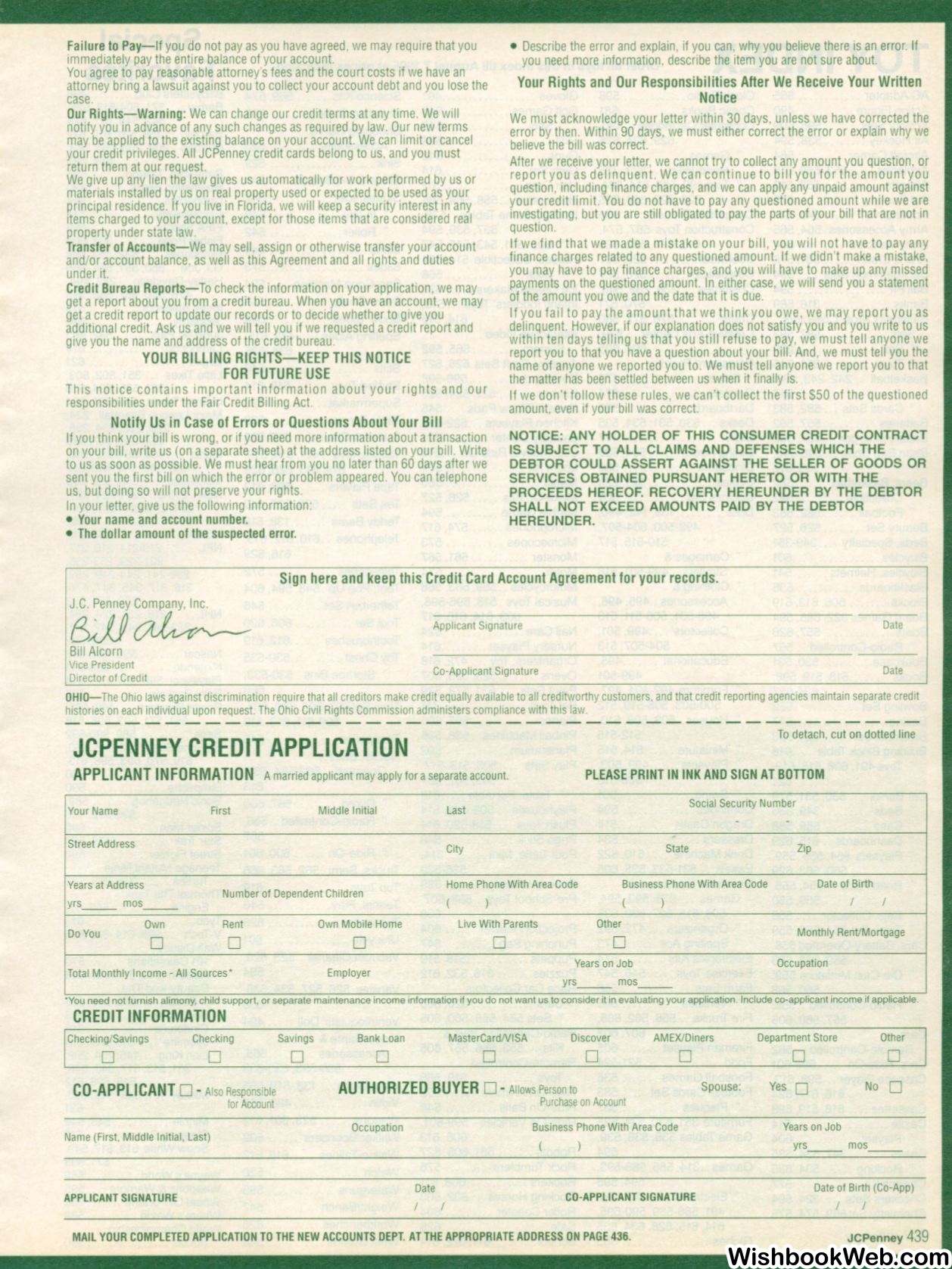

Sign here and keep thisCred it Card Account Agreement for your records.

J.C. Penney Company, Inc.

(3;}J~

Bill Alcorn

Vice President

Director of Credit

Applican1 Signa1ure

Da1e

Co-Applican1 Signa1ure

Da1e

OHIO-The Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers. and that credit reporting agencies maintain separate credit

histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law.

JCPENNEY CREDIT APPLICATION

To

detach, cut on dotted line

APPLICANT INFORMATION

A married applicant may apply for aseparate account.

PLEASE PRINT IN INK AND SIGN AT BOTTOM

Your Name

First

Middle lni1ial

Last

Social Security Number

Street Address

City

State

Zip

Years at Address

Home Phone With Area Code

Business Phone With Area Code

Date of Birth

Number of Dependent Children

(

)

(

)

I

I

yrs__ mos

--

Own

Rent

Own Mobile Home

Live With Parents

Other

Do You

0

0

0

0

0

Mon1hly RenVMortgage

Years on Job

Occupa1ion

To1al Monthly Income -All Sources*

Employer

yrs__ mos

--

·vou need not furnish alimony, child support, or separate maintenance income information

1f

you do not want us to consider

1t

m

evaluating

your apphcat1on. Include co-apphcant income

1f

apphcable.

CREDIT INFORMATION

Checking/Savings

Checking

0

0

CO-APPLICANT

0 -

Also Responsible

for Account

Name (Firs1, Middle lni1ial, Las1)

APPLICANT SIGNATURE

Savings

0

Bank Loan

Mas1erCardNISA

Discover

AMEX/Diners

0

0

0

0

AUTHORIZED BUYER

0 -

Allows Person to

Spouse:

Purchase on Account

Occupation

Business Phone With Area Code

Date

CO-APPLICANT SIGNATURE

MAIL YOUR COMPLETED APPLICATION TO THE NEW ACCOUNTS DEPT. AT THE APPROPRIATE ADDRESS ON PAGE 436.

Departmen1 Store

Other

0

0

Yes

O

No

0

Years on Job

yrs__ mos

Da1e of Birth (Co-App)

I

I

JCPenney

439