THE JCPENNEY CREDIT CARD ACCOUNT PROGRAM

Regu lar Charge-Everything we offer in our catalogs and stores can

be bought on Regular Charge. Recordkeeping is simple! Our once-a–

month statements are complete, permanent records of you r purchase.

Major Purchase Charge-Many types of merchandise from our

catalog may be charged as major purchases. There is a minimum

purchase requirement of

$200.

This minimum purchase requi rement

consists of the cost of merchandise plus transportation-and-handling

charges plus sales tax, if applicable. (Individual items need not cost

$200,

b ut the total of all items purchased on any single sales

transaction must be

$200.)

You don't have to finish payments on your

first purchase before you buy again if you have avai lable credit. You

can count on payments that stay the same each month unless you add

on purchases to a new "highest balance". The monthly payment may

vary slightly when shipping and taxes are included.

How To Open A JCPenney Credit Account

If you are not mailing a catalog order and wish to apply for a

JCPenney Credit Account, call

1-800-222-6161

and a credit

application wil l be mailed to you for your completion.

If you are mailing a catalog order and you also wish to apply for a

JCPenney Credit Account, read the fol lowing Credi t Card

Account Agreement thoroughly, and sign on page 439.

THIS AGREEMENT G IVES YOU THE INFORMATION YOU

NEED TO CHARGE A PURCHASE ORDER TO A C REDIT

ACCOUNT IF YOUR APPLICATION IS APPROVED. YOU

WI LL RECEIVE A COPY OF ALL THE CREDIT TERMS THAT

WILL APPLY TO YOUR ACCOUNT WHEN YOU RECEI VE

YOUR JCPENNEY CREDIT CARD(S).

Then complete the application on page 439 and sign it. This

verifies that you've read the Credit Card Account Agreement

below and that the information you've supplied on the JCPenney

Credit Account Application is accurate. Please print and use a

ball point pen (not a felt-tip) when you fill out the application. Mail

the application, with your order, to the Atlanta or Milwaukee

Distribution Center, c/o New Accounts Department, to the

appropriate address on page 436.

If you live 1n Arkansas, Delaware, Hawaii , North Dakota, or West

Virginia, the following Credit Agreement does not apply to you.

Please call the

800

number above and a credit application will

be sent to you. If you live in Puerto Rico, the following Credit

Agreement also does not apply to you V1s1t your local

JCPenney store for the correct Credit Agreement.

JCPenney Credit Card Account

Agreement

T his Credit Agreemen t does not apply to customers who live in

Arkansas , Delaware, Hawaii, North Dakota, or West Virginia. It also

does not apply to customers whose accounts will be billed by

JCPenney's Credit Office in Puerto Rico. See the How To Open A

JCPenney Credit Account box above.

In this agreement,

you

and

your

mean anyone who has applied for and

been accepted for a JCPenney Credit Account.

We, us,

and

our

mean

the J.C. Penney Company, Inc., P. O. Box

10001,

Dallas, Texas

75301-

0001 .

To find out if there have been any changes to the credit terms of th is

agreement, write to JCPenney Credit Department , P.O. Box

300,

Dallas, TX

75221.

Grace Period-You do not pay any finance charge if the re is no

previous balance or if credits and payments made within

25

days of the

current billing date equal the balance at the beginning of the period.

Finance Charge- Finance charge not in excess of that permitted by

law will be assessed on the outstanding balance from month to month.

We figure the finance charge by applying the periodic rate(s) for your

state to the average daily balance (ADS) of your account. See Balance

Computation Methods below.

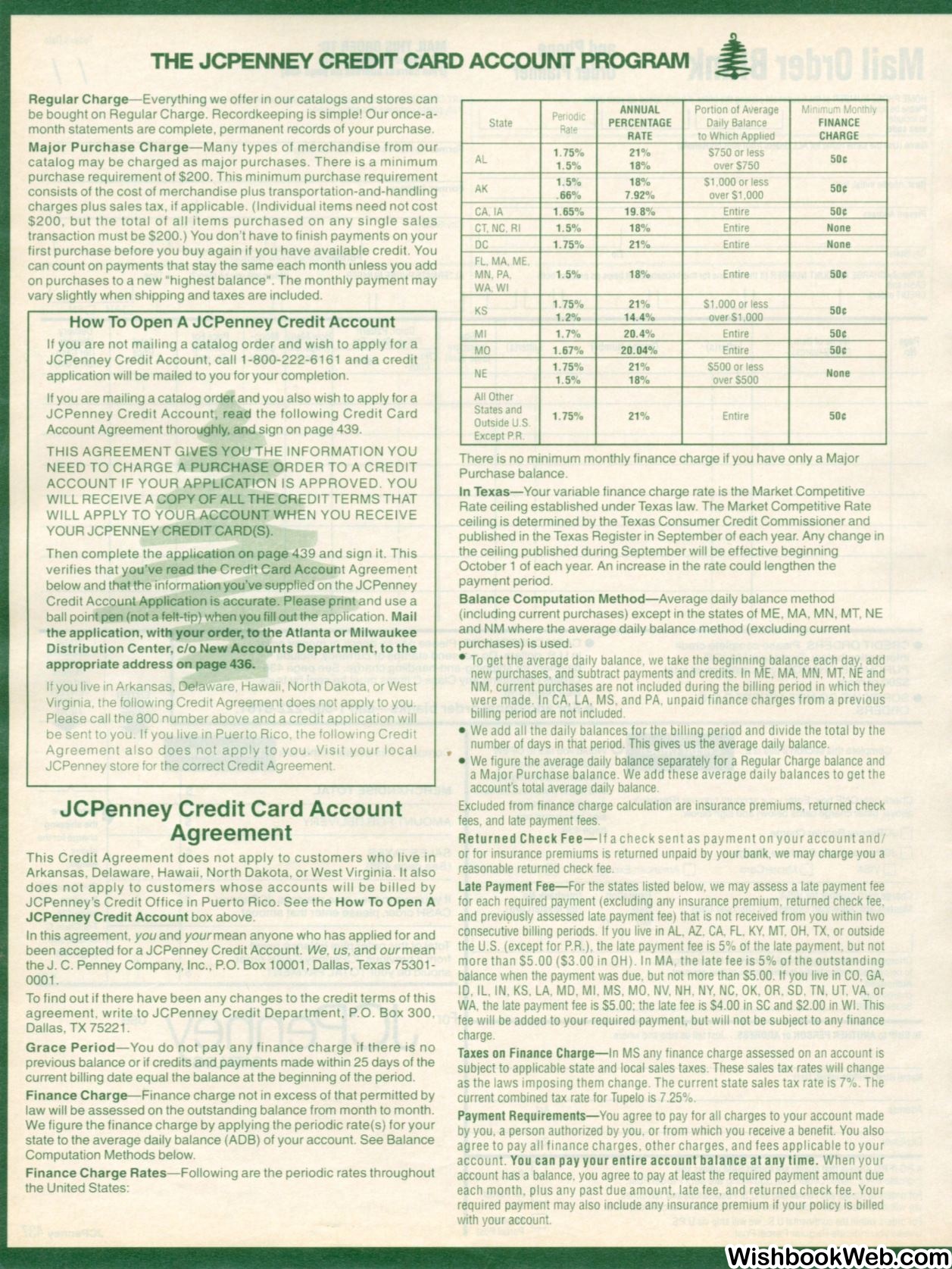

Finance Charge Rates-Following are the periodic rates throughout

the United States:

•

Periodic

ANNUAL

Portion of Allerage

Minimum Monthly

State

Rate

PERCENTAGE

Dally Balance

FINANCE

RATE

to Which Applied

CHARGE

AL

1.75%

21%

S750 or less

50¢

1.5%

18%

over $750

AK

1.5%

18%

$1,000 or less

50¢

.66%

7.92%

over S1 ,000

CA, IA

1.65%

19.8%

Entire

50¢

CT, NC, RI

1.5%

18%

Entire

None

DC

1.75%

21%

Entire

None

FL, MA, ME.

MN, PA,

1.5%

18%

Entire

50c

WA.WIKS

1.75%

21%

$1,000 or less

50¢

1.2%

14.4%

over S1 ,000

Ml

1.7%

20.4%

Entire

50¢

MO

1.67%

20.04%

Entire

50~

NE

1.75%

21%

$500 or less

None

1.5%

18%

over $500

All Other

States and

1.75%

21%

Entire

50¢

Outside U.S.

Except P.R.

There is no minimum monthly finance charge if you have only a Major

Purchase balance.

In Texas-Your variable finance charge rate is the Market Competitive

Rate ceiling established under Texas law. The Market Competitive Rate

ceiling is determined by the Texas Consumer Credit Commissioner and

published in the Texas Register in September of each year. Any change in

the ceiling published during September will be effective beginning

October

1

of each year. An increase in the rate could lengthen the

payment period.

Balance Computation Method-Average daily balance method

(including cu rrent purchases) except in the states of ME, MA, MN, MT, NE

and NM where the average daily balance method (excluding current

purchases) is used.

• To get the average daily balance, we take the beginning balance each day, add

new purchases, and subtract payments and credits. In ME, MA, MN, MT, NE and

NM, current purchases are not included during the billing period in which they

were made. In CA, LA, MS. and PA, unpaid finance charges from a previous

billing period are not included.

• We add all the daily balances for the billing period and divide the total by the

number of days in that period. This gives us the average daily balance.

• We figure the average daily balance separately for a Regular Charge balance and

a Major Purchase balance. We add these average daily balances to get the

account's total average daily balance.

Excluded from finance charge calculation are insurance premiums, returned check

fees, and late payment fees.

Returned Check Fee- If a check sent as payment on your account and /

or for insurance premiums is returned unpaid by your bank, we may charge you a

.reasonable returned check fee.

Late Payment Fee-For the states listed below, we may assess a late payment fee

for each required payment (excluding any insurance premium. returned check fee.

and previously assessed late payment fee) that is not received from you within two

consecutive billing periods If you live in AL,

Al.

CA, FL, KY. MT. OH. TX, or outside

the U.S. (except for P.R.) , the late payment fee is 5% of the late payment. but not

more than $5.00 ($3.00 in OH ). In MA. the late fee is 5% of the outstanding

balance when the payment was due, but not more than $5.00. If you live in CO, GA,

ID, IL, IN , KS, LA, MD, Ml , MS, MO, NV, NH , NY, NC, OK, OR , SD, TN, UT, VA. or

WA, the late payment fee is $5.00; the late fee is $4.00 in SC and $2.00 in WI This

fee will be added to your required payment, but will not be subject to any finance

charge.

Taxes on Finance Charge-In MS any finance charge assessed on an account is

subject to applicable state and local sales taxes. These sales tax rates will change

as the laws imposing them change. The current state sales tax rate is 7% . The

current combined tax rate for Tupelo is 7.25%.

Payment Requirements-You agree to pay for all charges to your account made

by you, a person authorized by you, or from which you receive a benefit. You also

agree to pay all finance charges , other charges , and fees applicable to your

account. You can pay your entire account balance at any time . When your

account has a balance, you agree to pay at least the required payment amount due

each month, plus any past due amount. late fee , and returned check fee. Your

required payment may also include any insurance premium if your policy is billed

with your account.