t

r

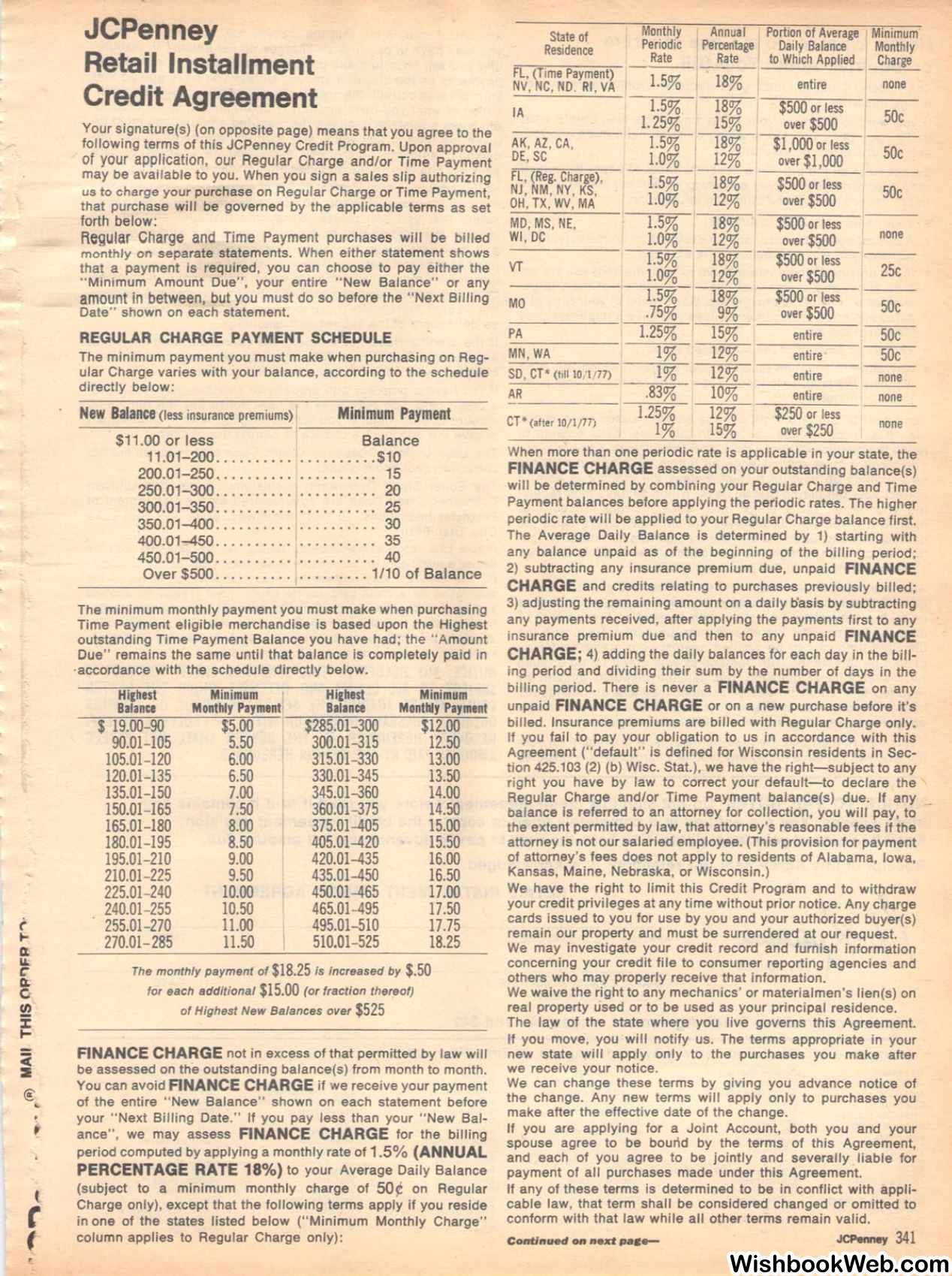

JCPenney

Retail Installment

Credit Agreement

Your signature(s) (on opposite page) means that you agree to the

following

ter~s

?f this JCPenney Credit Program. Upon approval

of your apphcat1on, our Regular Charge and/or Time Payment

may be available to you. When you sign a sales slip authorizing

us to charge your purchase on Regular Charge or Time Payment,

that purchase will be governed by the applicable terms as set

forth below:

Regular Charge

and Time Payment purchases will be billed

monthly on separate statements. When either statement shows

that a payment is required, you can choose to pay either the

"'Minimum Amount Due", your entire "New Balance" or any

amount

in between, but you must do so before the "Next Billing

Date" shown on each statement.

REGULAR CHARGE PAYMENT SCHEDULE

The minimum payment you must make when purchasing on Reg–

ular Charge varies with your balance, according to the schedule

directly below:

New Balance

(less insurance premiums)

I

Minimum Payment

$11.00

or less

1

Balance

11.01-200 .................... $10

200.01-250 .................... 15

250.01-300. . . . . .. . . . . . . . . . . . . . 20

300.01-sso ..........

I. . . . . . . . . .

25

350.01-400 . ......... ,. . . . . . . . . . 30

400.01-450 . .........

1· • . . • . . . • •

35

450.01-500. . .. . . . . . . .. . . . . .. . .

40

Over

$500 ................... 1/10

of Balance

The minimum monthly payment you must make when purchasing

Time Payment eligible merchandise is based upon the Highest

outstanding Time Payment Balance you have had; the " Amount

Due" remains the same until that balance is completely paid in

·accordance with the schedule directly below.

Hichest

Minimum

I

Hichest

Minimum

--~B-al~an_c~e

__

M_o_nt-'-h$""1y

5

~.P

0

=a

0

~ym_e_nt_~=B~a=1a_nce=~-M_o_n~thl""'y~P=a~ym_e_nt

$ 19.00-90

$285.01-300

$12.00

90.01-105

5.50

300.01-315

12.50

105.01-120

6.00

315.01-330

13.00

120.01-135

6.50

330.01-345

13.50

135.01-150

7.00

345.01-360

14.00

150.01-165

7.50

360.01-375

14.50

165.01-180

8.00

375.01-405

15.00

180.01-195

8.50

405.01-420

15.50

195.01-210

9.00

420.01-435

16.00

210.01-225

9.50

435.01-450

16.50

225.01-240

10.00

450.01-465

17.00

240.01-255

10.50

465.01-495

17.50

255.01-270

11.00

495.01-510

17.75

270.01-285

11.50

510.01-525

18.25

The monthly payment of

$18.25

is increased by

$.50

for each additional

$15.00

(or fraction thereof)

of Highest New Balances over

$525

FINANCE CHARGE

not in excess of that permitted by law will

be assessed on the outstanding balance(s) from month to month.

You can avoid

FINANCE CHARGE

if we receive your payment

of the entire " New Balance" shown on each statement before

your "Next Billing Date." If you pay less than your "New Bal–

ance", we may assess

FINANCE CHARGE

for the billing

period computed by applying a monthly rate of

1.5% (ANNUAL

PERCENTAGE RATE 18%)

to your Average Daily Balance

(subject to a minimum monthly charge of

50¢

on Regular

Charge only), except that the following terms apply if you reside

in one of the states listed below ("Minimum Monthly Charge"

column applies to Regular Charge only):

State of

Monthly

Annual

Portion of Average Minimum·

Residence

Periodic

Percentage

Daily Balance

Monthly

Rate

Rate

to Which Applied

Charge

FL, (Time Payment)

----

NV, NC, ND. RI, VA

1.53

183

entire

none

IA

1.53

183

$500

or less

50c

1.253

153

over

$500

AK, AZ, CA,

1.53

183

$1,000

or less

50c

DE,SC

1.03

123

over

$1,000

FL, (Reg. Charge),

1.53

183

$500

or less

NJ, NM, NY, KS,

soc

OH, TX, WV, MA

1.03

123

over

$500

MD, MS, NE,

1.53

183

$500

or less

WI, DC

1.03

123

over

$500

none

VT

1.53

183

$500

or less

25c

1.03

123

over

$500

MO

1.53

183

$500

or fess

50c

.753

93

over

$500

PA

1.253

153

entire

50c

MN , WA

13

123

entire

50c

SD, CT*

(till 10; 1

/77)

13

123

entire

none

AR

.833

103

entire

none

CT*

(after

10/ 1/77)

1.253

123

$250

or less

none

13

153

over

$250

When more than one periodic rate is applicable in your state, the

FINANCE CHARGE

assessed on your outstanding balance(s)

will be determined by combining your Regular Charge and Time

Payment balances before applying the periodic rates. The higher

periodic rate will be applied to your Regular Charge balance first.

The Average Daily Balance is determined by

1)

starting with

any balance unpaid as of the beginning of the billing period;

2) subtracting any insurance premium due, unpaid

FINANCE

CHARGE

and credits relating to purchases previously billed;

3) adjusting the remaining amount on a daily b"asis by subtracting

any payments received, after applying the payments first to any

insurance premium due and then to any unpaid

FINANCE

CHARGE;

4) adding the daily balances for each day in the bill–

ing period and dividing their sum by the number of days in the

billing period. There is never a

FINANCE CHARGE

on any

unpaid

FINANCE CHARGE

or on a new purchase before it's

billed. Insurance premiums are billed with Regular Charge only.

If you fail to pay your obligation to us in accordance with this

Agreement ("default" is defined for Wisconsin residents in Sec–

tion

425.103

(2) (b) Wisc. Stat.), we have the right-subject to any

right you have by law to correct your default-to declare the

Regular Charge and/or Time Payment balance(s) due. If any _

balance is referred to an attorney for collection, you will pay, to

the extent permitted by law, that attorney's reasonable fees if the

attorney is not our salaried employee. (This provision for payment

of attorney's fees does not apply to residents of Alabama, Iowa,

Kansas, Maine, Nebraska, or Wisconsin.)

We have the right to limit this Credit Program and to withdraw

your credit privileges at any time without prior notice. Any charge

cards issued to you for use by you and your authorized buyer(s)

remain our property and must be surrendered at our request.

We may investigate your credit record and furnish information

concerning your credit file to consumer reporting agencies and

others who may properly receive that information.

We waive the right to any mechanics' or materialmen's lien(s) on

real property used or to be used as your principal residence.

The lay.t of the state where you live governs this Agreement.

If you move, you ·will notify us. The terms appropriate in your

new state will apply only to the purchases you make after

we receive your notice.

We can change these terms by giving you advance notice of

the change. Any new terms will apply only to purchases you

make after the effective date of the change.

If you are applying for a Joint Account, both you and your

spouse agree to be bourid by the terms of this Agreement,

and each of you agree to be jointly and severally liable for

payment of all purchases made under this Agreement.

If any of these terms is determined to be in conflict with appli–

cable law, that term shall be considered changed or omitted to

conform with that law while all other terms remain valid.

Continued on next

fnlll-

JCPenney

341