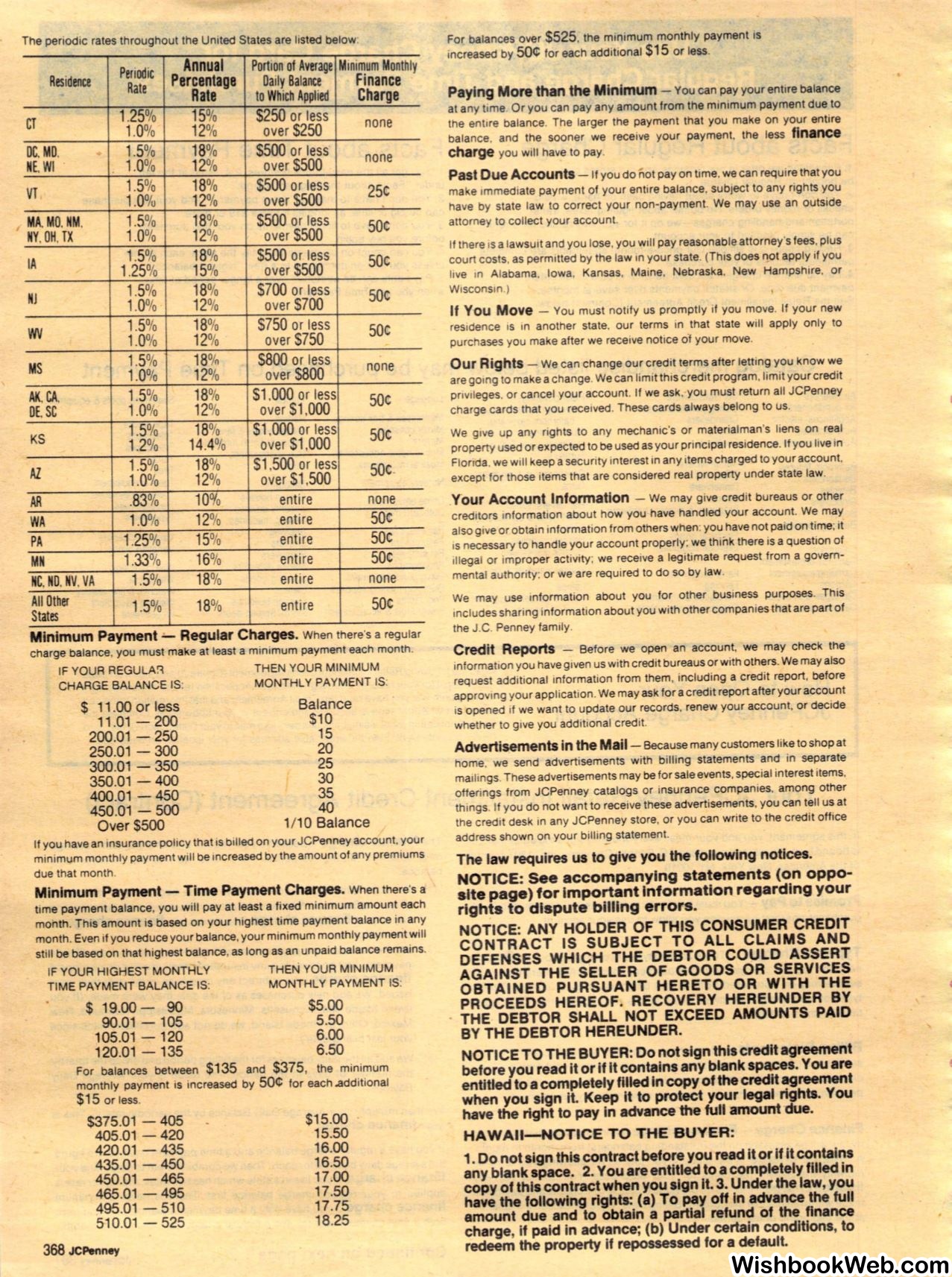

The periodic rates throughout the United States are listed below:

Periodic

Annual

Portion of Average Minimum Monthly

Residence

Rate

Percentage

DailyBalance

Finance

Rate

toWhich Applied

Charge

CT

1.25%

15%

$250

or less

1.0%

12%

over

$250

none

DC. MO.

1.S%

18%

$SQQ

or less

NE. WI

1.0%

12%

over

$SOO

none

VT

1.5%

18%

$SOO

or less

2SC

1.0%

12%

over

$SOO

MA.MO.NM.

1.5%

18%

$SOO

or less

soc

NY .OH.TX

1.0%

12%

over

$SOO

IA

1.S%

18%

$SOO

or less

soc

1.2S%

1S%

over

$500

NJ

1.5%

18%

$700

or less

soc

1.0%

12%

over

$700

WV

1.5%

18%

$7SO

or less

soc

1.0%

12%

over

$7SO

MS

1.S%

18%

$800

or less

none

1.0%

12%

over

$800

AK. CA,

1.S%

18%

$1.000

or less

501!:

DE. SC

1.0%

12%

over

$1,000

KS

1.5%

18%

$1.000

or less

soc

1.2%

14.4%

over

$1 ,000

Al.

1.S%

18%

$1 ,SOO

or less

SOC-

1.0%

12%

over

$1 ,SOO

AR

.83%

10%

entire

none

WA

1.0%

12%

entire

soc

PA

1.25%

1S%

entire

soc

MN

1.33%

16%

entire

50¢

NC,NO.

NV.VA1.S%

18%

entire

none

All Other

1.S%

18%

entire

soc

States

Minimum Payment - Regular Charges.

When there's a regular

charge balance, you must make at least a minimum payment each month.

IF YOUR REGULAR

THEN YOUR MINIMUM

CHARGE BALANCE IS:

MONTHLY PAYMENT IS:

$ 11.00

or

less

11 .01 -

200

200.01 -

250

250.01 -300

300.01 -350

350.01 -

400

400.01 -450

450.01 -

500

Over $500

Balance

$10

15

20

25

30

35

40

1/ 10

Balance

If you have an insurance policy that is billed on your JCPenney account,your

minimum monthly payment will be increased by the amount of any premiums

due that month.

Minimum Payment - Time Payment Charges.

When there's a

time payment balance, you will pay at least a fixed minimum amount each

mohth. This amount is based on your highest time payment balance in any

month. Even if you reduce your balance, your minimum monthly payment will

still be based on that highest balance, as long as an unpaid balance remains.

IF YOUR HIGHEST MONTHLY

THEN YOUR MINIMUM

TIME PAYMENT BALANCE IS:

MONTHLY PAYMENT IS:

$ 19.00 -

90

90.01 -

105

105.Q1 -

120

120.01 -135

$5.00

5.50

6.00

6.50

For balances between

$135

and

$375,

the minimum

monthly payment is increased by

50¢

for each .additional

$15

or less.

$375.01 -

405

405.01 -420

420.01-435

435.01 -450

450.01 -465

465.01 -495

495.01 -

510

510.01 -

525

368

JCPenney

$15.00

15.50

16.00

16.50

17.00

17.50

17.75

18.25

For balances over

$525.

the minimum monthly payment is

increased by

50¢

for each additional

$1 5

or less.

Paying More than the Minimum -

You can pay your entire balance

at any tome. Or you can pay any amount from the minimum payment due to

the entire balance. The larger the payment that you make on your entire

balance. and the sooner we receive your payment, the less

finance

charge

you will have to pay.

Past Due Accounts -

If you do not pay on time,we can require that you

make immediate payment of your entire balance, subject to any rights you

have by state law to correct your non-payment. We may use an outside

attorney to collect your account.

If

there 1s a lawsuit and you lose, you will pay reasonable attorney's fees,plus

court costs, as permitted by the law on your state. (This does '!Ot apply if you

live on Alabama. Iowa, Kansas, Maine, Nebraska, New Hampshire, or

Wisconsin.)

If You Move -

You must notify us promptly if you move.

If

your new

residence 1s in another state. our terms in that state will apply only to

purchases you make after we receive notice ol your move.

Our Rights -

We can change our credit terms after letting you know we

are going to make a change. We can limit this credit program, limit your credit

privileges. or cancel your account. If we ask. you must return all JCPenney

charge cards that you received. These cards always belong to us.

We give up any rights to any mechanic's or materialman's liens on real

property used or expected to

be

used as your principal residence.

If

you live in

Florida. we will keep a security interest in any items charged to your account.

except for those items that are considered real property under state law.

Your Account lnfonnatlon -

We may give credit bureaus or other

creditors information about how you have handled your account. We may

also giveor obtain onformation from others when:you have not paid on time; it

is necessary to handle your account properly: we think there is a question of

illegal or improper activity; we receive a legitimate request from a govern–

mental authority: or we are required to do so by law.

We may use information about you for other business purposes. This

includes sharing information about you with other companies that are part of

the J.C. Penney family.

Credit Reports -

Before we open an account,

we may check the

information you havegiven us with credit bureaus or with others.We may also

request additional information from them, including a credit report, before

approving your

application.We may ask for a credit report after your account

is opened 1f we want to update our records, renew your account. or decide

whether to give you additional credit.

Advertisements In theMail -

Because many customers like to shop at

home, we send advertisements with billing statements and in separate

mailings. These advertisements may be for sale events, special interest items.

offerings from JCPenney catalogs or insurance companies, among other

things. If you do not want to receive these advertisements, you can tell us at

the credit desk on any JCPenney store, or you can write to the credit office

address shown on your billing statement.

The law requires us to give you the following notices.

NOT ICE:

See accompanying statements (on oppo–

site page) for Important information regarding your

rights to d ispute billing errors.

NOTICE: ANY HOLDER OF THIS CONSUMER CREDIT

CONTRACT IS SUBJECT TO ALL CLAIMS AND

DEFENSES WHICH THE DEBTOR COULD ASSERT

AGAINST THE SELLER OF GOODS OR SERVICES

OBTAI NED PURSUANT HERETO OR WITH THE

PROCEEDS HEREOF. RECOVERY HEREUNDER BY

THE DEBTOR SHALL NOT EXCEED AMOUNTS PAID

BY THE DEBTOR HEREUNDER.

NOTICETO THE BUYER: Do not sign thiscredit agreement

before you read it or if

it

contains any blank

sp~s.

You are

entitled to acompletely filled In copy of the credit agreement

when you sign It. Keep It to protect your legal rights. You

have the right to pay In advance the full amount due.

HAWAII-NOTICE TO THE BUYER:

1. Do not sign this contract before you read it or If It contains

any blank space. 2. You areentitled to a completely filled in

copy of this contract when you sign it. 3. Under the law, you

have the following rights: (a) To pay off In advance the full

amount due and to obtain a partial refund of the finance

charge, if paid in advance; (b) Under certain conditions, to

redeem the property if repossessed for a default.